Newswise — At midnight Monday, some 45,000 dockworkers and port operators at 36 Eastern and Gulf ports from Maine to Texas went on strike. The walkout, the first dockworkers’ strike since 1977, comes at an especially precarious time with several Eastern states reeling from the devastation of Hurricane Helene, the oncoming holiday season, and just as the economy was beginning to bustle again.

Negotiations for a new master contract began nearly two years ago, according to media reports.

Alex Niemeyer, an associate professor of professional practice with the University of Miami Patti and Allan Herbert Business School’s Department of Management Science, assessed the labor stalemate and its implications for the U.S. economy. Niemeyer’s previous experience includes more than 20 years as a consultant with McKinsey & Company for Fortune 500 companies.

How should we gauge the importance to the U.S. economy of this strike?

If the strike lasts longer than a couple days, the impact on the economy will be very significant. During the strike, ships cannot be unloaded, thus they back up and have to wait. That costs extra fees, but more importantly, it reduces shipping capacity, as these ships are not free again to go back to Europe or Asia and pick up more goods. Extensive delays, just as during COVID, would result. And this creates strong inflationary pressure, as due to shortages prices will rise in addition to extra shipping costs.

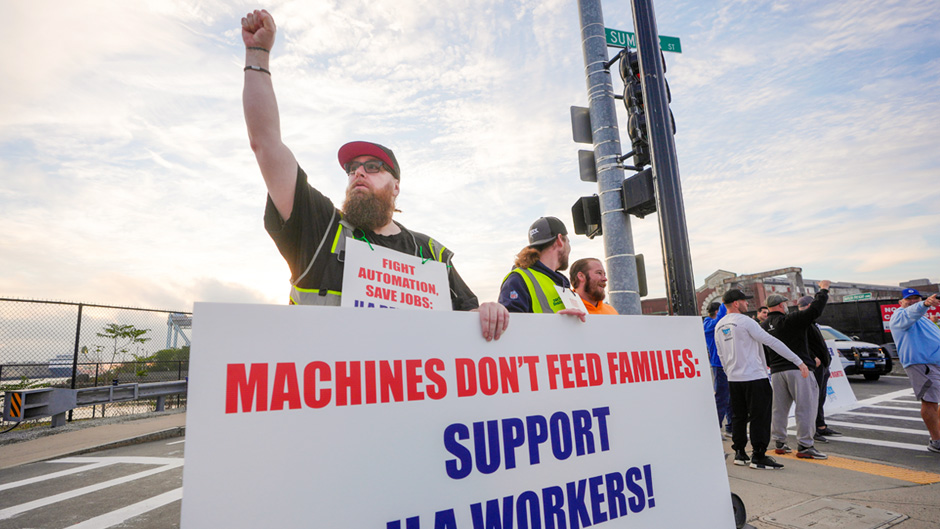

In addition to seeking higher wages, the International Longshoremen’s Association is calling for a complete ban on automation, cranes, gates, and container-moving trucks. How feasible is this demand? What facets of the dockers’ activity is already automated?

The most advanced ports in the world are seeing a lot of automation. While wage demands are somewhat justified (despite longshoremen being very highly paid compared to other manual labor), this limits productivity improvement and thus makes the ports covered under this agreement less competitive in the long run.

The U.S. Maritime Alliance (USMX), which represents the industry, reportedly brought in billions of dollars during the pandemic charging elevated costs. Who controls the Maritime Alliance, and what are their primary interests?

Members are the shipping companies and the terminal/port operators. This strike is unusual in that the shippers benefit from this strike. Just like during the port congestion during COVID, any delays in shipping lead to shortages of containers and shipping capacity, which dramatically inflates prices. During the pandemic, a container from China to the U.S. at times cost $20,000 versus the more typical $2,000 to $5,000. Companies like Maersk and others thus generated previously unheard-of profits. So, surprisingly, an extended strike will make a lot of money for the shippers, and in the end, consumers pay for it all, and inflation will increase again.

The government appears to be standing aside, at least for now. What actions could the government take to help resolve this strike?

Since this is happening during the election season, President Joe Biden’s hands are tied. Putting the strike on pause by enacting the existing law (Taft-Hartley Act) would be possible but would send a strong signal that the Democratic Party does not stand with workers.